These actuarial tables do not apply to valuations under chapter 1 subchapter d relating to qualified retirement arrangements nor.

Single life expectancy table calculator.

This calculator determines the minimum required distribution known as both rmd or mrd which is really confusing from an inherited ira based on the irs single life expectancy table.

Note that the minimum is different for spouses and non spouse beneficiaries.

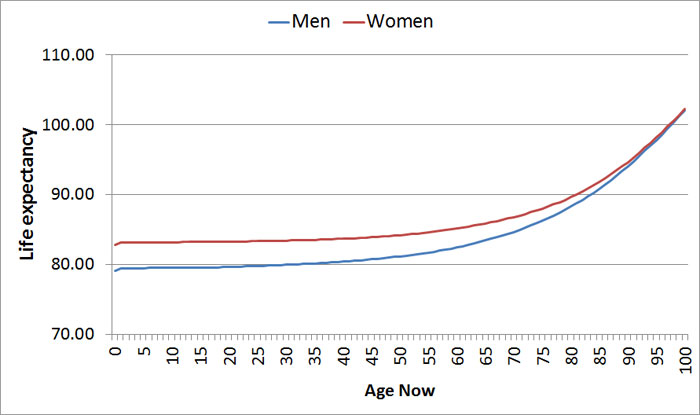

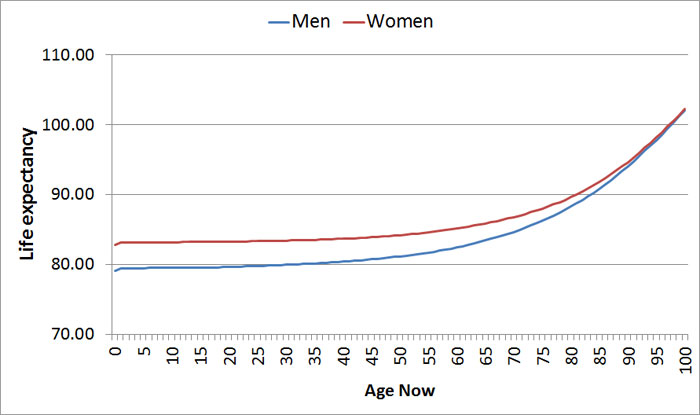

Actual longevity is based on many factors not all of which are captured here.

The calculator is based on table i from irs publication 590 b 2014 which is one of three irs tables used to determine required minimum distributions rmds for qualifying retirement.

To make the comparison easier the calculator only shows monthly tsp installment payments since annuity payments are always monthly.

The information provided by fidelity investments is general in nature and should not be considered legal or tax advice.

Results from this life expectancy calculator should not be interpreted as definitive.

Sometimes referred to mortality tables death charts or actuarial life tables this information is strictly statistical.

This table does not use your beneficiary s age to calculate your life expectancy.

Choosing single life expectancy will produce the highest distribution of the three available.

This calculator assumes you do not have a terminal illness and does not ask about most serious diseases other than diabetes.

This calculator will calculate life expectancy based on how long the irs is betting you will live and then display your life odometer based on that result.

Life expectancy tables actuarial life tables.

Results are based on a statistical regression of.

It does not take into consideration any personal health information or lifestyle information.

This calculator estimates how a given amount of money might translate into monthly income whether through tsp installment payments or through the various life annuity options.

Fidelity does not provide legal or tax advice.

This table can be used by all account owners regardless of marital status or selected beneficiary.

If the beneficiary is an individual to figure the required minimum distribution for 2020 divide the account balance at the end of 2019 by the appropriate life expectancy from table i single life expectancy in appendix b.

Determine the appropriate life expectancy as follows.

This is a non sex based life expectancy table.